The U.S. federal budget deficit saw a significant decrease in January, driven by a record-breaking surge in tariff revenues. According to Treasury Department data, tariffs collected $30 billion in January alone, averaging nearly $1 billion per day, which directly contributed to easing the federal government's financial burden.

Background of trade policies and tariffs

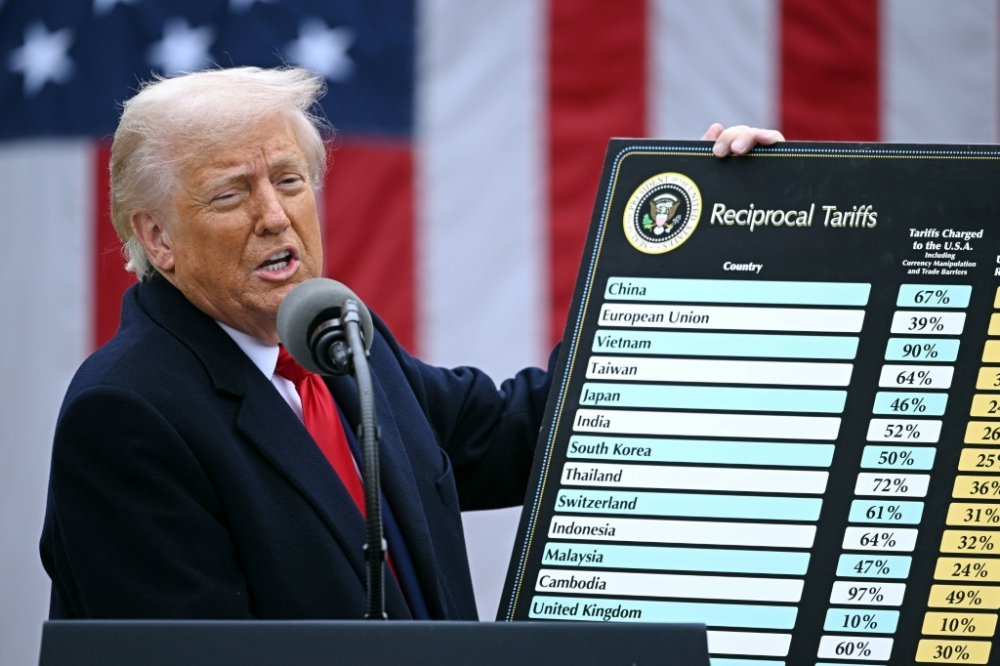

The roots of this significant revenue surge can be traced back to the shift in US trade policy that began under the administration of former President Donald Trump. In 2018, the administration initiated a series of sweeping tariffs under the banner of “America First,” aiming to protect domestic industries and reduce the country’s trade deficit, particularly with China. These measures included imposing Section 301 tariffs on billions of dollars’ worth of Chinese goods, as well as Section 232 tariffs on steel and aluminum imports from various countries worldwide. Despite the change in administration, many of these tariffs remained in place, resulting in a steady flow of customs revenue into the US Treasury.

The numbers speak for themselves: direct impact on the budget

A Treasury Department report showed that total customs revenue since the start of the current fiscal year has reached $124 billion, a massive 304% increase compared to the same period last year. This influx of revenue helped reduce the budget deficit for January to approximately $95 billion, a 26% decrease from the same month last year. For the full fiscal year to date, the federal deficit stands at $697 billion, representing a 17% decrease from the same period of the previous fiscal year.

Importance and local and international economic impacts

Domestically, these tariffs provide the government with an additional source of income that can help fund public services or reduce the need for borrowing. However, economists debate who truly bears the burden of these tariffs, with many studies indicating that American importers are the ones who pay them, often passing the additional cost on to consumers in the form of higher prices. Internationally, these policies have led to trade tensions and tit-for-tat tariff wars, with countries like China and the European Union imposing retaliatory tariffs on American goods, impacting US exporters and reshaping global supply chains. While the stated aim was to protect industry, the debate continues regarding the effectiveness of these tariffs in achieving their long-term objectives compared to the costs they have imposed on both the domestic and global economies.

This comes at a time when the US national debt continues to rise, currently standing at approximately $38.6 trillion, making the cost of servicing this debt (its interest) an increasing burden on the budget. Net interest payments reached $76 billion in January alone, exceeding most other government spending items.