Mixed performance in UK markets: FTSE 100 rises, sterling falls

British financial markets saw mixed performance on Thursday, with the FTSE 100 index posting slight gains while the pound continued its decline against major currencies such as the US dollar and the euro. This divergence reflects a cautious and watchful stance among investors regarding the future of the British economy and global monetary policies.

At the close of trading in London, the British pound fell 0.04% against the US dollar to $1.3801. It also edged down slightly against the euro by 0.02%, trading at €1.1549. This decline comes amid a stronger US dollar, supported by expectations of continued monetary policy from the Federal Reserve and persistent concerns about the UK's growth prospects.

Background and context of economic performance

The performance of the British pound comes within a complex global and domestic economic context. Since Brexit, the economy has faced structural challenges related to trade and investment. High global inflation rates are also putting pressure on the Bank of England to make difficult decisions regarding interest rates. Any hint of a slower-than-expected tightening of monetary policy, or the release of weak economic data, could negatively impact the currency's value.

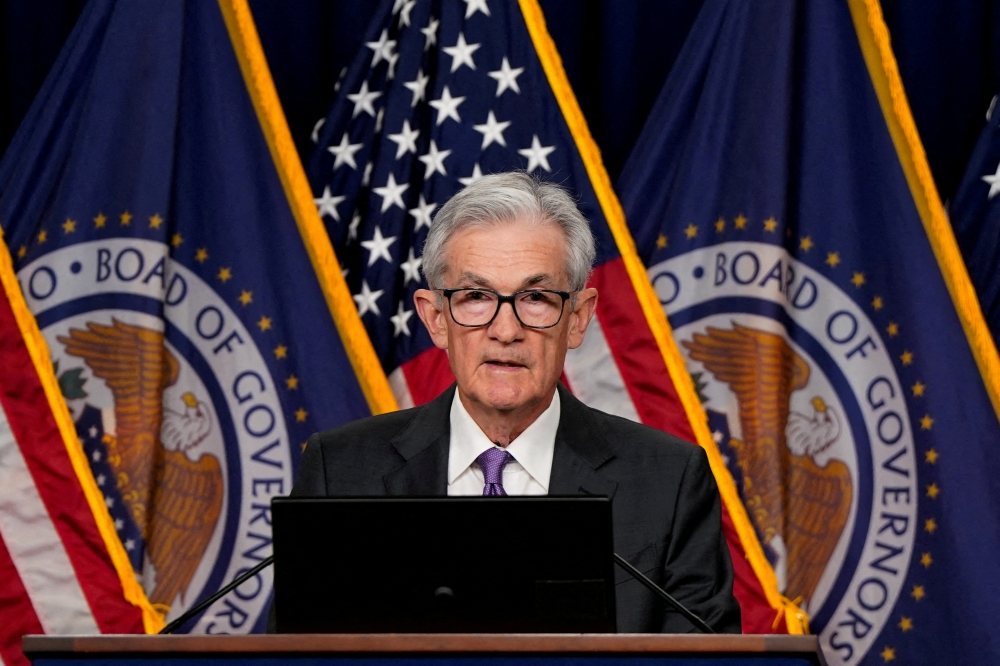

Globally, decisions by major central banks, such as the US Federal Reserve and the European Central Bank, directly impact currency pairs. When the Fed raises interest rates or even hints at doing so, the dollar tends to appreciate globally, putting pressure on other currencies like the pound sterling.

Why does the FTSE 100 index rise when the pound weakens?

In contrast, the FTSE 100 index, which tracks the 100 largest companies listed on the London Stock Exchange, closed 0.17% higher. The index gained 17.33 points to reach 7171.76.

This rise might seem paradoxical given the currency's weakness, but there's a well-known inverse relationship between the pound and the FTSE 100. This is because many of the large companies listed on the index are international firms that generate a significant portion of their profits in foreign currencies. When the pound falls, the value of these profits increases when converted back to pounds, boosting their share prices and driving the index higher.

Expected impacts on the economy and investors

The weakness of the pound has mixed effects. On the one hand, it makes British exports cheaper and more competitive in global markets, which could support the manufacturing and services sectors. On the other hand, it increases the cost of imports, including energy and raw materials, which could exacerbate inflationary pressures on consumers and businesses in the UK.

For international investors, a weaker pound offers an opportunity to buy British assets at a lower cost, but it carries risks related to continued currency volatility and economic uncertainty. The performance of UK markets remains closely tied to the path of inflation and future Bank of England policy decisions, as well as the stability of the global political and economic landscape.