Former US President Donald Trump announced that he will reveal the name of his new nominee to head the Federal Reserve (the US central bank) next week, a move that global financial markets are watching with great interest due to its profound impact on the future of monetary policy for the world's largest economy.

In a statement, Trump said, “Sometime next week, we will announce the Federal Reserve Chair,” adding confidently, “It will be someone who I think will do a very good job.” This announcement comes amid a period of repeated criticism from Trump of the central bank and its policies.

Background to the decision and importance of the position

The position of Chairman of the Federal Reserve is one of the most important economic posts in the world, granting the holder significant independence in determining the course of US monetary policy. The Fed's primary mission is to achieve two main objectives: price stability (controlling inflation) and maximizing employment opportunities. To achieve these goals, the Fed employs powerful tools, most notably controlling key interest rates, which affect the cost of borrowing for businesses and individuals.

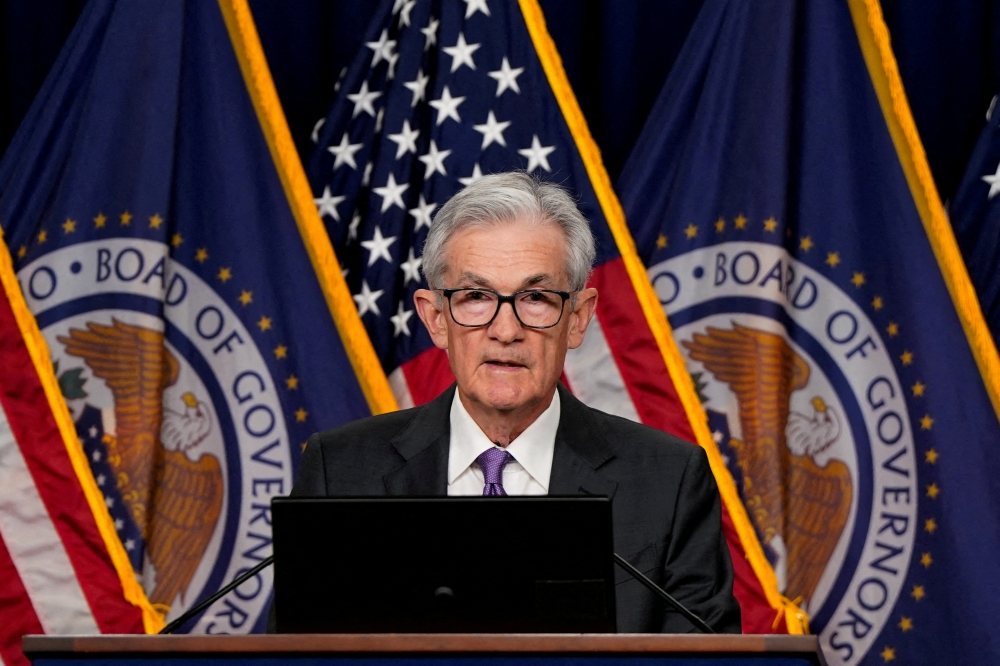

Historically, US presidents have maintained a tradition of respecting the independence of the central bank and avoiding public comment on its decisions. However, Trump's presidency broke with this tradition, as he repeatedly criticized the current chairman, Jerome Powell, whom he himself appointed, arguing that the interest rates set by the bank were "too high, unacceptably high," and that they were hindering economic growth.

Expected impact on the local and global economy

The decision to choose the next Federal Reserve chair doesn't just affect the United States; its repercussions extend to the entire global economy. Domestically, interest rates influence everything from mortgages and auto loans to companies' investment decisions and hiring decisions.

Internationally, the Federal Reserve's decisions directly affect the value of the US dollar, the world's primary reserve currency. Any change in US monetary policy can cause volatility in global exchange markets, impact capital flows, and increase the burden of dollar-denominated debt on developing countries and emerging markets.

Current monetary policy context

This anticipation comes at a sensitive time. On the Wednesday preceding the announcement, the Federal Reserve decided to keep interest rates unchanged, after having cut them three times during 2019 in an attempt to support the economy in the face of a global slowdown and trade tensions. Current Chairman Jerome Powell's term ends in February 2022, but Trump's decision to nominate a new candidate now opens the door to a potential change in leadership at the world's most important financial institution, putting markets on high alert.