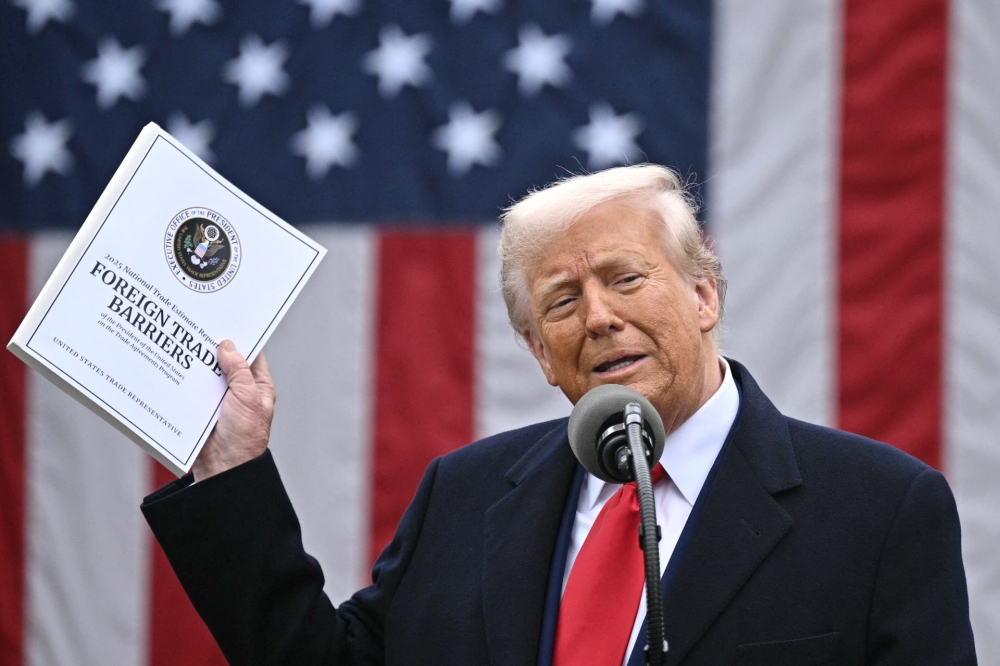

In an escalating move that could reshape global trade, former US President Donald Trump announced on Friday that he had signed an executive order imposing a new, sweeping 10% tariff on all imports into the United States from all countries. This decision directly challenges the recent Supreme Court ruling that struck down his previous tariff policy, which had been a cornerstone of his “America First” economic agenda.

Trump wrote on his Truth Social platform: “It is a great honor to sign, from the Oval Office, a 10% international tariff applicable to all countries, effective almost immediately.” This announcement reflects Trump’s determination to pursue his protectionist policies, which he considers essential for protecting American industries and jobs.

General context and historical background of the decision

Tariff policies were not new to the Trump administration during its presidency (2017-2021). It adopted a staunchly protectionist approach, waging trade wars with key economic partners, most notably China, which was subjected to billions of dollars in tariffs. Its policies also included imposing tariffs on steel and aluminum from close allies such as the European Union, Canada, and Mexico, under the pretext of protecting US national security. The stated goal of these measures was to reduce the US trade deficit and force other countries to make trade concessions—a policy that sparked widespread debate among economists and policymakers worldwide.

The importance of the event and its expected impact

This decision carries with it wide-ranging economic and political repercussions at the local, regional and international levels.

Domestically, a blanket 10% tariff is expected to raise prices for imported goods, directly impacting American consumers and exacerbating inflationary pressures. Companies reliant on imported components and raw materials will also face increased production costs, potentially reducing their competitiveness. Conversely, some domestic industries may benefit from temporary protection against foreign competition.

Internationally, this move will almost certainly be met with retaliatory measures from the United States' trading partners, threatening to ignite a new global trade war. Countries like China and the European Union may impose counter-tariffs on US exports, harming vital sectors such as agriculture and technology. Furthermore, this decision challenges the rules-based global trading system of the World Trade Organization (WTO) and could lead to further geopolitical tensions and erode trust in international trade relations.