Comprehensive health insurance for pilgrims: A pioneering step by the Council of Cooperative Health Insurance

As part of its ongoing efforts to provide the best services to pilgrims, the Council of Cooperative Health Insurance in Saudi Arabia announced details of the “Health Coverage Policy for Pilgrims from Outside the Kingdom.” This initiative aims to provide a comprehensive health safety net that ensures the comfort and well-being of pilgrims throughout their stay and covers any emergency medical situations they may encounter.

Historical context: A firm commitment to serving pilgrims and Umrah performers

Since its founding, the Kingdom of Saudi Arabia has placed paramount importance on the care of pilgrims performing Hajj and Umrah, recognizing its immense responsibility as the custodian of the Two Holy Mosques. Healthcare services provided to pilgrims have developed significantly over the decades, from field hospitals and seasonal health centers to a sophisticated healthcare system and modern hospitals in Makkah and Madinah. The mandatory health insurance policy represents a modern and advanced step in this direction, shifting healthcare from simply responding to emergencies to providing proactive and organized protection, in line with the goals of the Kingdom's Vision 2030, which aims to enhance the Hajj and Umrah experience and elevate the quality of services provided.

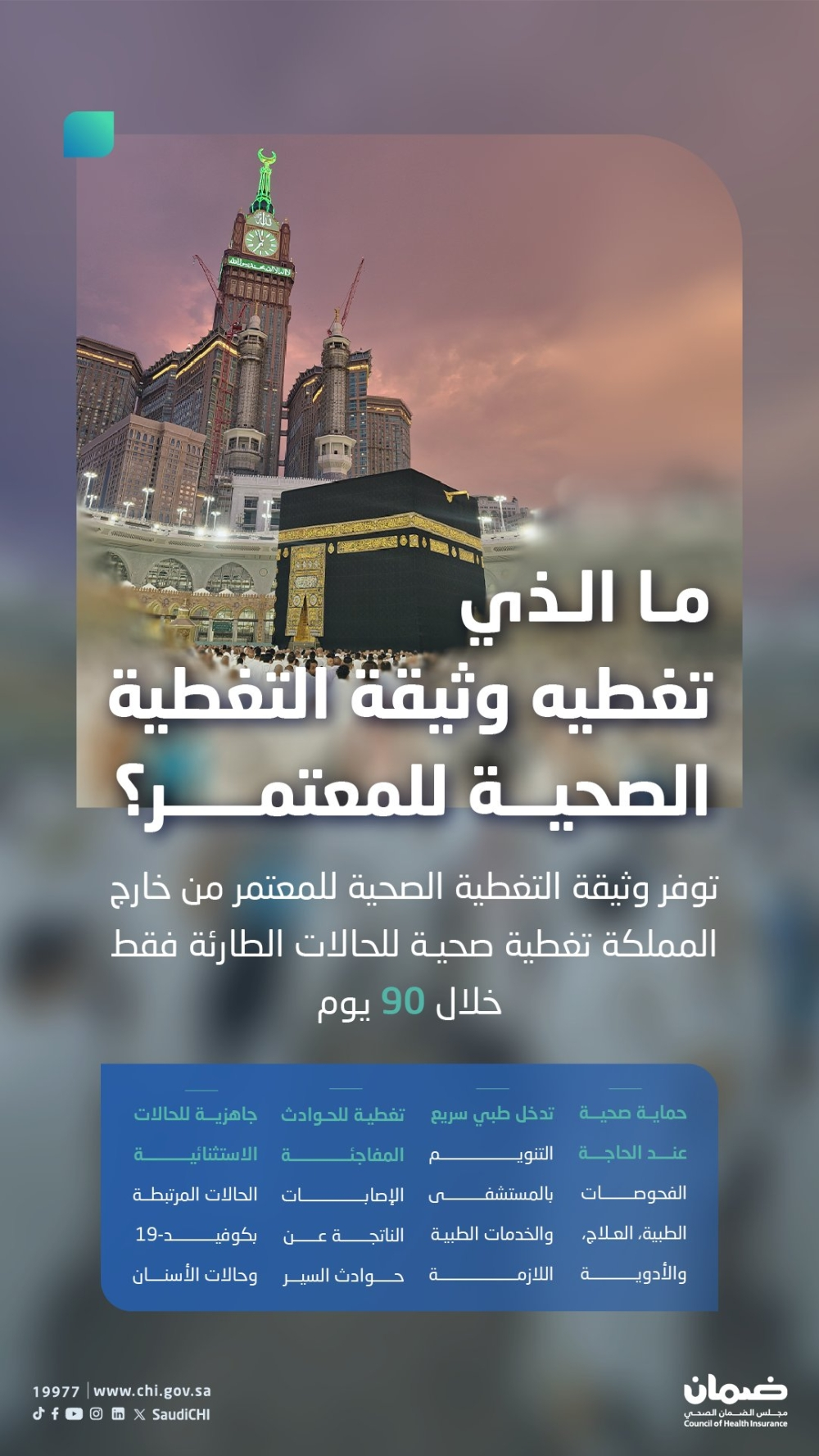

What benefits are covered by the pilgrim insurance policy?

The health insurance policy for pilgrims arriving from outside the Kingdom provides comprehensive coverage for emergencies only, for a period of up to 90 days from the date of the pilgrim's entry into the Kingdom. The basic benefits include the following:

1. Health protection when needed

- Medical examinations and treatment: Coverage of costs for medical diagnosis, necessary treatments, and prescribed medications.

- Hospitalization: This includes staying in hospitals when medically necessary, with the provision of all necessary medical services.

2. Coverage for unforeseen events

- Traffic accident injuries: Coverage of emergency medical cases resulting from traffic accidents.

3. Readiness for exceptional circumstances

- COVID-19-related cases: Coverage of treatment costs for confirmed positive cases.

- Dental emergencies: include treatment of emergency conditions such as abscesses, emergency fillings, and other procedures necessary to relieve pain.

- Emergency pregnancies and childbirth.

- Emergency medical evacuation within and outside the Kingdom.

The importance and expected impact of the document

The significance of this document extends beyond simply providing treatment; it represents a part of a comprehensive national strategy. Domestically , it contributes to regulating the healthcare sector and alleviating pressure on public hospitals, while strengthening the role of the insurance sector as a key partner in the healthcare system. Internationally , it enhances the Kingdom's image as a leader in crowd management and the provision of world-class services, and reassures millions of Muslims worldwide that their health and safety are a top priority when they come to perform their religious rites.

Wide range of health coverage in the Kingdom

This initiative reflects the Council of Cooperative Health Insurance's commitment to expanding insurance coverage. Statistics indicate that the number of subscribers to the mandatory health insurance policy exceeds 14 million beneficiaries, including approximately 4.5 million Saudis and 9.5 million non-Saudis, underscoring the pivotal role the Council plays in achieving a sustainable, healthy society and enabling access to high-quality healthcare services for all residents and visitors of the Kingdom.