Global demand for gold reached a new record high in 2025, driven by economic and geopolitical uncertainty that compelled investors and central banks to seek refuge in the precious metal. According to the World Gold Council's annual report, the policies adopted by the administration of US President Donald Trump were the primary driver behind this unprecedented surge.

Historical background: Gold as a safe haven

Throughout history, gold has proven its worth as a strategic asset sought by investors and nations during times of crisis. In periods of political turmoil, war, high inflation, or currency devaluation, gold tends to maintain or even increase its value. We witnessed this behavior during the 2008 global financial crisis, when gold prices surged as confidence in traditional financial markets collapsed. The current surge in demand reflects a repetition of this historical pattern, with gold being viewed as an insurance policy against sharp fluctuations in the global financial system.

The impact of Trump's policies on global markets

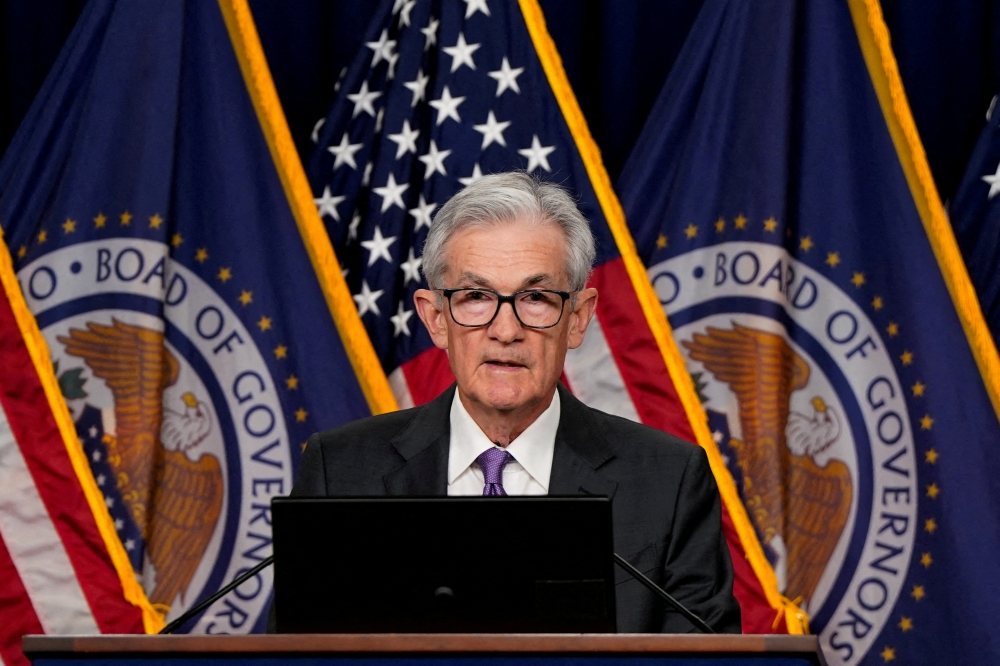

A World Gold Council report indicated that gold purchases in 2025 exceeded 5,000 tons, valued at $555 billion, representing a 45% year-on-year increase. Krishan Gopal, an expert at the council, explained that “uncertainty” was the decisive factor. This uncertainty was evident in several key policies of the Trump administration, most notably the imposition of punitive tariffs on major trading partners such as China, the European Union, and India, which ignited a global trade war that threatened the stability of supply chains and raised fears of a global economic slowdown. Furthermore, Trump’s repeated criticism of the Federal Reserve’s policies eroded confidence in the independence of the US central bank, weakening the dollar and prompting investors to seek safe havens.

Central banks boost their gold reserves

Demand wasn't limited to individual and institutional investors; central banks worldwide also saw a significant increase in their gold purchases. This move is part of a broader strategy known as "de-dollarization," whereby many countries, particularly emerging economies, seek to reduce their reliance on the US dollar in their foreign reserves. As a result, the proportion of gold in global central bank reserves has risen to over 20%, the highest level since the early 1990s. This shift not only reflects a lack of confidence in US policies but also represents a strategic shift in the global economic balance of power.

Exchange-traded funds (ETFs) and future prospects

Another factor contributing to the surge in demand is the growing popularity of gold-backed exchange-traded funds (ETFs). These financial instruments have given individual investors easy access to the gold market, making it as simple as buying a share in a gold-backed fund as buying a company stock. With the factors that fueled this surge continuing into 2025, experts predict that demand will remain strong in 2026. The new year has already begun with a remarkable performance, as the price of an ounce of gold reached a new record high, surpassing $5,300, confirming that the precious metal will remain central to global financial hedging strategies for the foreseeable future.