European stock markets saw a mixed close to trading on Thursday, with the performance of the main indices reflecting a state of anticipation and caution among investors amid conflicting economic data and uncertainty surrounding the monetary policies of major central banks.

In closing details, the pan-European STOXX 600 index, which includes a selection of the continent's largest companies, recorded a slight decline of 0.23%, settling at 607.14 points. This decline was primarily driven by the negative performance of the German market, where the DAX index, the main index on the Frankfurt Stock Exchange, plummeted by a significant 2.13%, closing at 24,293.24 points, impacted by concerns related to the manufacturing and automotive sectors, which are major pillars of the German economy.

In contrast, the French CAC 40 index managed to achieve marginal gains of 0.06%, ending the session at 8071.36 points, supported by a relatively strong performance from luxury goods and services stocks that are resilient to economic fluctuations.

General context and impact of economic factors

This mixed performance comes within a complex global economic context. In Europe, investors are still closely analyzing inflation data and economic growth indicators in the Eurozone. Although inflation rates have fallen from their peak, the European Central Bank is taking a cautious approach to interest rate cuts, emphasizing the need to ensure that inflation's downward trajectory towards its 2% target remains sustainable.

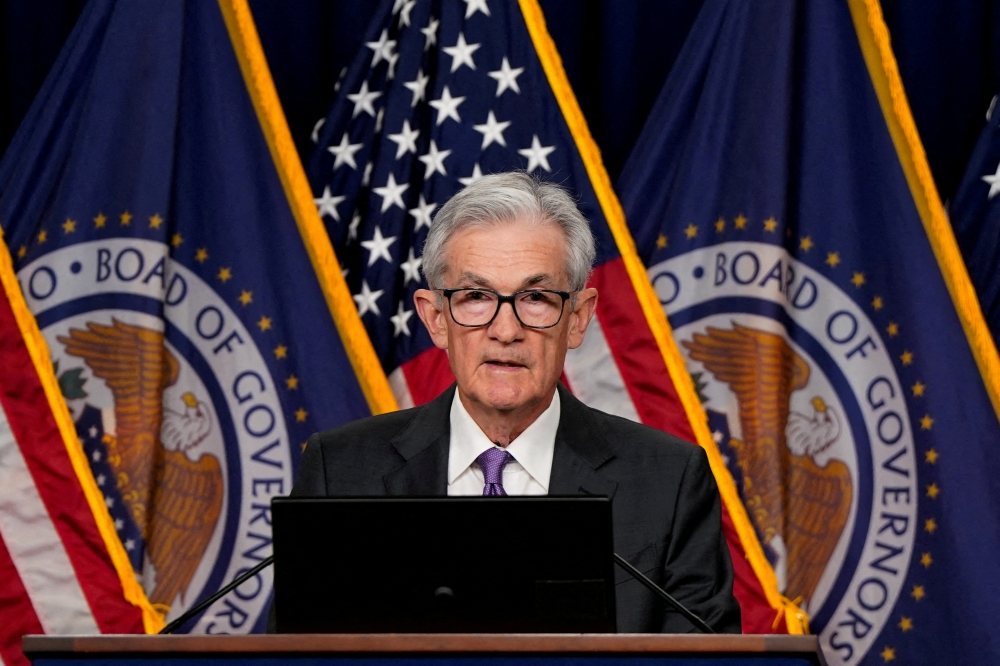

Historically, European markets have been highly sensitive to monetary policy, not only from the European Central Bank but also from the US Federal Reserve. Any hints of a delay in US interest rate cuts directly affect global risk appetite, which in turn impacts the performance of European stock markets.

Importance and expected effects

The divergent performance of key indicators, particularly between the German and French economies, highlights the different structural challenges within the Eurozone. While Germany's export-dependent economy is suffering from slowing global demand and intense competition, other sectors in economies like France are showing greater resilience.

Regionally, this performance impacts consumer and business confidence, and continued weakness in the German index could lead to a revision of growth forecasts for the Eurozone as a whole. Internationally, foreign investors monitor these indicators as a gauge of the health of the European economy, and continued uncertainty could divert investment flows to other markets perceived as more stable. The future performance of European equities remains contingent on clarity regarding interest rates, geopolitical stability, and the ability of companies to adapt to the changing economic environment.